Each cryptocurrency has such addresses, which contain a huge amount of funds. Whales of different cryptocurrencies usually hide themselves and remain anonymous. At the same time, they can greatly affect the exchange rate fluctuation both up and down.

Why is it important to keep track of such addresses? How dangerous can crypto whales be? In our today’s article, we’ll try to find out!

What Are Cryptocurrency Whales?

The cryptocurrency addresses which contain a very large amount of one type of crypto asset are called crypto whales. No certain amount would allow us to confidently say: ‘Yes, this address is definitely a whale.’ This happens because the concept of a large number of funds is different for each person. For some people, 1 bitcoin is already a lot, and for others, thousands are not enough.

If we talk about generally accepted concepts, then big addresses are those which contain, for example, 100 bitcoins or more. However, such holders also cannot be confidently called whales.

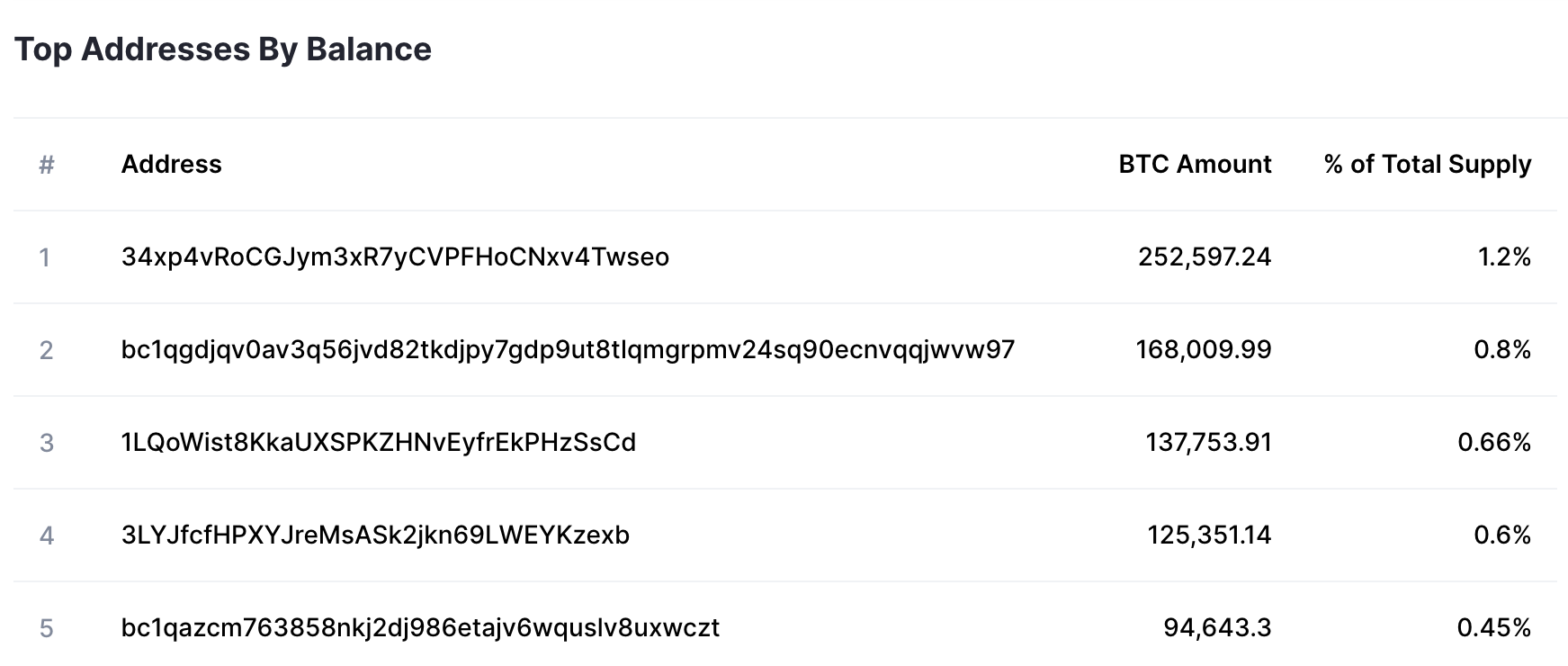

You can find out who is the top holder of a certain cryptocurrency via blockchain and special services. For example, by going to CoinMarketCap and scrolling down to ‘Top Addresses By Balance,’ you can see wallet addresses, the amount of bitcoin they contain, and the percentage of the total asset supply.

Thus, we see that crypto whales are those who occupy the first positions of holding an asset in the ranking. That is, most often, a holder can be a whale of bitcoin but at the same time not have ether or any other cryptocurrency in their account.

Crypto Whales Are More Than Just Individual Addresses

However, it is not always the case that the top address is the biggest holder of an asset. Cryptocurrency can also be owned by companies, corporations, holdings, or just a group of very wealthy individuals who buy up an asset and store it in different wallets.

Thus, one separate wallet of, let’s say, MicroStrategy may not contain so many bitcoins. Still, in fact, it is one of BTC’s biggest holders. Therefore, this also needs to be taken into account.

Top 5 Biggest Bitcoin (BTC) Holders

-

- In the first place is the mysterious and enigmatic creator of Bitcoin, Satoshi Nakamoto. According to various sources, up to 1.1 million bitcoins can be on his account, and this is about 5% of the entire BTC supply. If desired, Satoshi could greatly influence the price of bitcoin. However, no one knows who he really was and where he is now.

Read Next: Who Is Satoshi Nakamoto: Everything You Need to Know

-

- The cold wallets of the most popular and largest exchange, Binance, contain about 265,000 bitcoins. This is a really impressive amount, and at the moment, it is believed that there is no more bitcoin in one address than here.

-

- Bulgaria has about 213,000 bitcoins at its disposal. The Bulgarian government got them after they were seized during a special operation to capture a dangerous criminal group with a colossal amount of bitcoins in its account. However, Bulgaria does not disclose its future intentions regarding these bitcoins.

-

- The BitFinex exchange has 168,000 bitcoins in its cold wallet.

-

- MicroStrategy is the largest holder of bitcoin among global public corporations. The company owns 130,000 bitcoins as of October 28, 2022, and constantly buys a certain amount of bitcoin both on the fall and on the rise. The average purchase price was $30,623 per bitcoin, with a total cost of $3.981 billion USD.

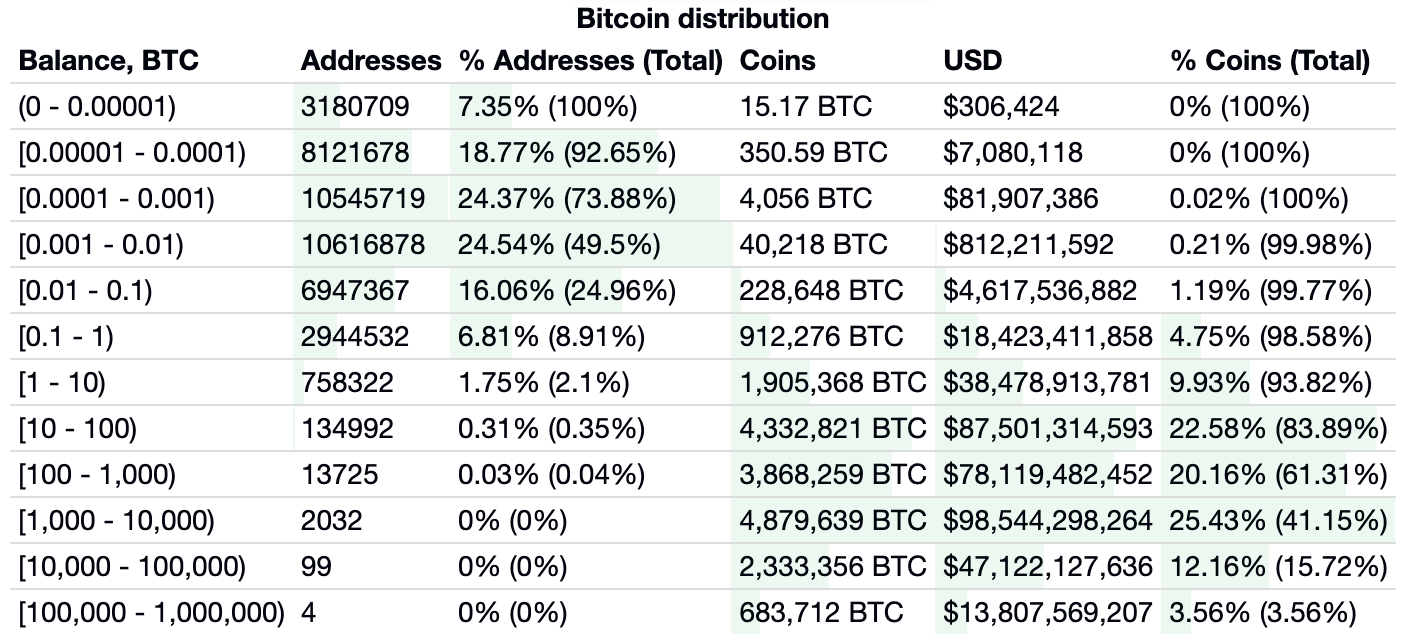

In fact, the really big whales of bitcoin can be called addresses with more than 50,000 BTC in their account.

How Do Crypto Whales Manipulate Cryptocurrency?

The biggest danger whales can pose to any cryptocurrency is its impact on its rate. Cryptocurrency, blockchain, and bitcoin are primarily a decentralized world in which one person or group of persons cannot influence the value of assets in any way. That’s the beauty of decentralization. But whales can easily upset this balance.

Here is a striking situation that happened with bitcoin back in 2014. In October, bitcoin was in the so-called ‘flat’ when its price did not have a clear direction. Digital gold was then worth about $380, and nothing foretold a sharp fall or rise. However, one major whale address put up 30,000 BTC for sale. And he sold them at a price of $300. The price instantly dropped to this value, which was about a 25-30% price drop overnight.

How Much Other Coins Do Crypto Whales Have?

Other cryptocurrencies also have their own large holders. And often, if we are talking about recently issued coins, then the situation is much worse there. When a company launches its project, it allocates a large number of tokens to its team and creators. Sometimes these values can be higher than 20-30%.

Another interesting situation happened with the SushiSwap decentralized exchange’s coin. It was reported in the media that crypto whales were able to accumulate almost 10% of the total turnover of the Sushi coin in 2 months. Thus, if desired, they can greatly affect both the coin’s price and the project’s development. Which, of course, goes against the blockchain policy of decentralization and equal accessibility for everyone.

What Is the Best Place to Buy Cryptocurrency?

If you’re wondering where to buy some crypto, you should definitely think about doing it at Switchere. On our platform, you have an opportunity to buy all leading cryptocurrencies in the fastest and most convenient ways using any available payment method.

Switchere is one of the most reliable online exchanges for buying cryptocurrencies. The company is a licensed provider of financial services, with guaranteed legal compliance and a secure infrastructure system for fast crypto exchange services at fair prices.

Switchere is characterized by the fastest order processing and instant delivery — in fact, you get your ordered amount of crypto within minutes after making a payment. Moreover, we offer some surprising bonuses! Users of our platform enjoy a 0% service fee for the first order.

How Can Crypto Whales Affect the Cryptocurrency Future?

Crypto whales are a topic that does not cause much hype, interest, and alertness these days — although this is a mistake. So far, there is no such problem, and no one is worried about the control of a certain asset by a group of individuals. But more and more addresses are building up their capital — what could this theoretically lead to?

Well, suppose we are talking about a cryptocurrency, such as ether, which has unlimited emission (issue). In that case, whales do not pose a big problem for such ecosystems — simply because they won’t be able to hold most of the entire possible coin supply. At least it’s not that critical.

Still, the situation changes when we talk about bitcoin with a maximum total supply of only 21,000,000 coins. Just imagine that a quarter of the coins will be lost, and half will be concentrated in the hands of a narrow circle of individuals and companies buying digital gold. Ordinary people will be left with almost nothing of the already relatively small supply on the market.

Yes, this will pay off at first since the BTC price will skyrocket to hundreds of millions of dollars due to the small supply. But what if whales buy up even more assets and then sell them? Such cryptocurrencies may simply cease to be of interest to the community since there will be nothing to trade.

This question is extremely complex and ambiguous. Perhaps coin volumes will not concentrate and increase in such large proportions in one hand. At the same time, Bitcoin and other similar cryptocurrencies have a bright future. However, it is all just a matter of time.

Leave a Reply