The year 2021 was the most effective year for the cryptocurrency market since a strong growth in assets of any type was observed. The popularity of digital assets, technologies, and developments continues to grow, although today, one can see a significant correction and even fundamental coins have lost 80-95% of their peak rates. Every day, many new projects with native tokens appear, and their total number has passed over 20,000 types.

Top 5 Cryptocurrency Trend to Lookout For in 2023

The global crypto market cap today is less than $1 trillion, and by the end of 2022, a decrease to 300-500 billion dollars may occur, which will be within the normal correction of the active growth phase of 2021. According to statistics, more than 300 million people in the world use cryptocurrencies and digital tools for business, everyday life, and other areas.

Today we will consider the biggest trends in the cryptocurrency world that occur in 2022 and will continue throughout 2023 — some of them may continue until 2025 and beyond.

#1 Institutional Adoption of Cryptocurrencies

Financial companies and large global corporations remain sceptical about modern cryptocurrency ecosystems. However, some of them started investing significant capital in a similar area.

This has become very noticeable in asset management. At the end of 2020, about $15 billion was spent on cryptocurrencies under management. These are the contributions of institutional persons.

As an example, at the end of 2019, institutional investments in this market amounted to $2 billion, and the volume increased by more than 5 times in 1 year.

In 2020, insurance giant Massachusetts Mutual unveiled a $100 million investment in Bitcoin for its general investment account. Companies like MassMutual are facilitating the transition and adoption of cryptocurrencies worldwide.

A little later, other companies, including Square and MicroStrategy, began to join the trend. They shocked the entire business industry by investing huge amounts in digital assets.

Paypal and Venmo launched the ability to trade cryptocurrency on their platform. According to statistics from PayPal, customers who bought coins via the Paypal app visited the platform twice as often as before. At the end of 2021, the Chicago Mercantile Exchange launched micro Ether futures contracts.

Tracking the data of large wallets that store BTC, you can see that since 2020, the volumes have been rising — companies and individuals who have more than 1,000 BTC in storage are only increasing.

Read Next: How Do Crypto Whales Affect the Cryptocurrency Market?

All these changes point to the future of cryptocurrencies; the trend towards accumulating and storing assets continues and will continue. Large funds and investors tend to cryptocurrency investments without stopping their turnover.

#2 More DeFi Apps to Come

The development and emergence of decentralized finance (DeFi) are one of the main directions and trends that attract people to the cryptocurrency community. Over the past 5 years, the request in the search engine ‘Decentralized Finance’ has increased by 5,300%.

The main concept is classic financial transactions within a blockchain. Operations are carried out using smart contracts, but compared to traditional transfers and other financial services, they completely exclude third parties’ presence.

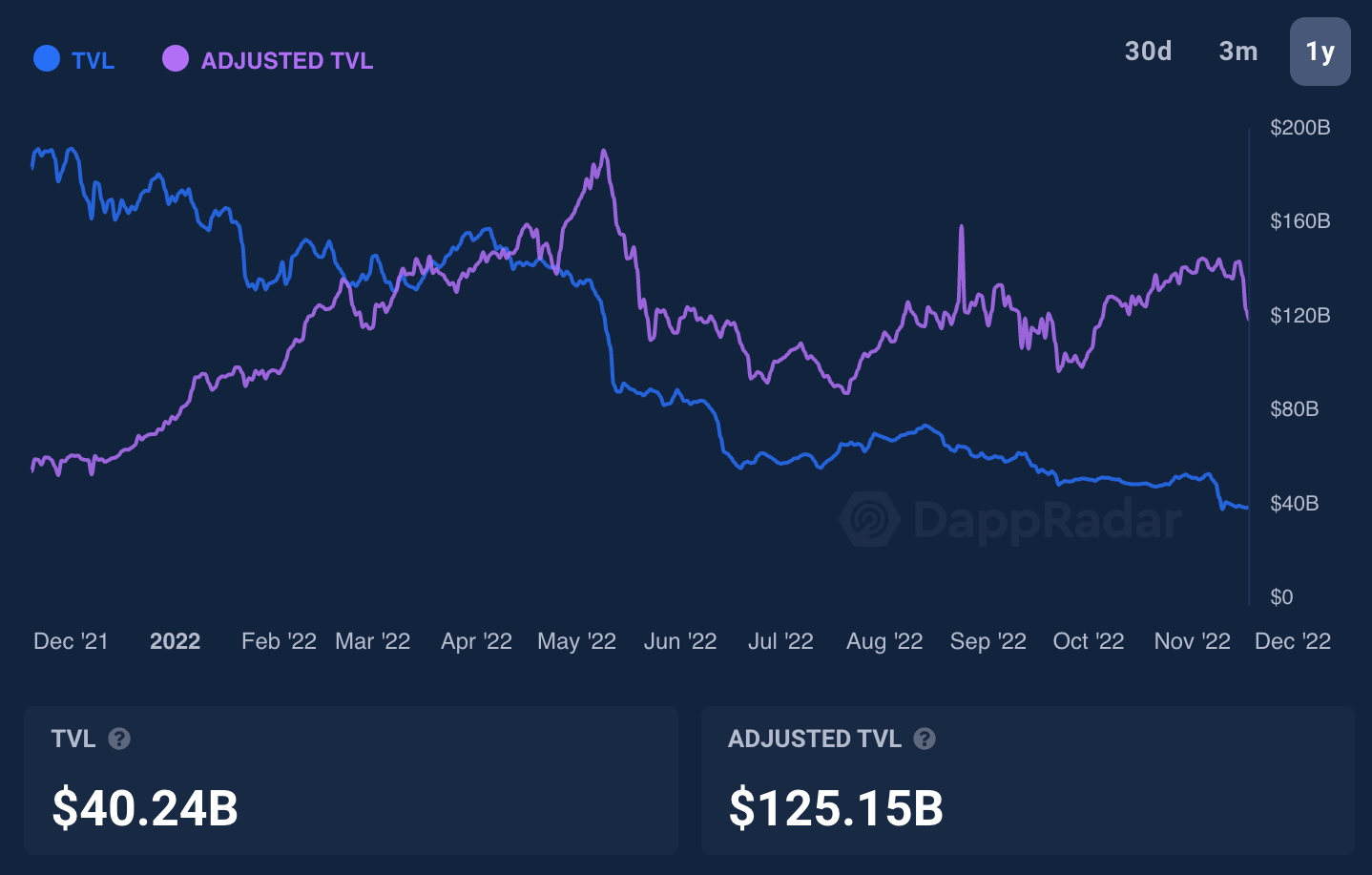

DeFi allows you to use lending and deposits, create derivatives, and conduct other operations. In 2023, according to many analysts, the rapid growth and development of the DeFi sector can be observed — its development is just beginning.

According to DeFi Pulse, the total value of digital assets associated with the DeFi sector has increased from $2 billion to $15 billion in 2020. A year later, the values already amounted to almost $100 billion.

Decentralized exchanges (DEX) are gaining great popularity in 2022. Search queries have doubled in the last 2 years. As mentioned before, such tools enable users to perform any operation with a digital asset directly, without third parties. They also provide ownership rights and 100% control of personal assets. Every month, trading volumes within decentralized platforms increase.

At the beginning of 2021, trading volumes were $56 billion, which is 1000% more than in 2020.

#3 NFT Boom

The NFT sector was still in 2017, but only now it is gaining momentum and popularity. Ordinary users and large investors were able to see all the advantages of the technology, within which creative exclusive arts or images can be sold for large sums. At the end of 2021, NFTs began to be more widely used as a technology, so this trend will definitely continue to be emphasized in 2023.

One should also remember about the GameFi sector and metaverses within which NFTs are used as their basis. Thus, for several years, metaverses and the gaming sector will be mainstream. Facebook and other large organizations, including Epic Games, began to engage in the development of metaverses.

This makes it possible to say that in the future, the development of such a niche will be rapid, and many project tokens will bring high ROI to its investors.

Due to the fragmentation of this market, it is difficult to accurately assess the total capitalization and scale. Looking at specific NFT platforms, you may get a general idea. Analysts estimated monthly trading volumes at the end of 2021 were at around $15 million. In 2022, the indicator increased, and these values will only grow in 2023.

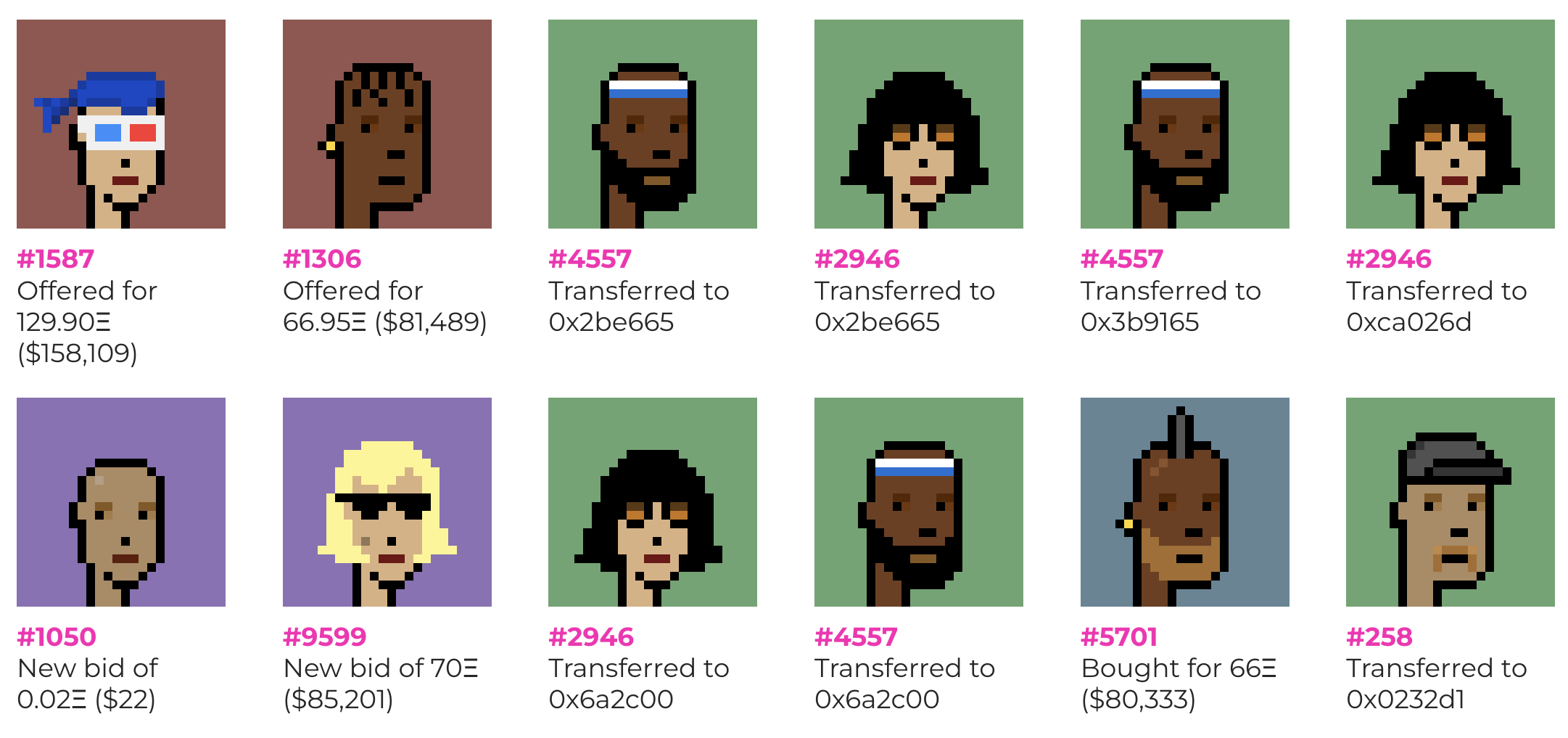

The idea of NFTs began to be popularized by projects like CryptoKitties and CryptoPunks. Their tokens gave ownership of collectables in the form of pixel art and digital cats.

Expert estimates showed that $40 million worth of transactions were carried out in the CryptoKitties project, and some NFTs were sold for $300,000. One of the most expensive images in the CryptoPunks collection is an image worth $762,000.

Since that time, the sector of non-fungible tokens began to develop, and more practical uses appeared, so the trend continues, especially noticeable in the art and game sector.

Read Next: Top 10 Best NFT Games 2022 to Play & Earn Cryptocurrency

#4 Crypto Market Regulation

As soon as technologies, cryptocurrencies, and other innovative blockchain developments began to gain popularity, states began to look closely at them. The strengthening of government control began in 2017 when there were ubiquitous ICOs.

In 2021, a little more clarity on the regulation of crypto markets appeared. However, legal issues related to the nature of digital assets are confusing regulators, and Ripple is a good example of this, showing a general trend.

In 2020, the SEC launched a case against Ripple Labs. The SEC is confident that the corporation was offering $1.3 billion in assets when most of the XRP coins were sold to ordinary users.

Central banks are trying to stay ahead of technology by providing markets with their own digital assets. Many believe that the active adoption and distribution of different types of stablecoins can cause strong speculation without the possibility of legal regulation. Central Bank tokens are called CBDC, and they are gradually introduced and studied by more than 80% of banks in the world.

Great Britain was the first to start working on such a project. The People’s Bank of China, in turn, wants to be the first in the world to implement cryptocurrency technology, and 2 CBDC pilot projects have been completed, issuing 20 million tokens for 2022. Today, even the US Federal Reserve began considering a project to create a digital dollar. If applied and successfully implemented, such an innovation could completely change the possibilities of international payments.

#5 DApp Market Expansion

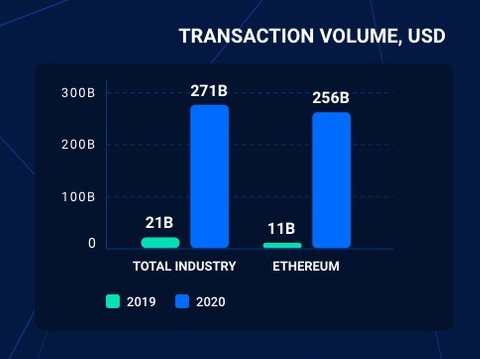

DApps are decentralized applications, programs that operate on a peer-to-peer network — the potential for this area is huge. DAppRadar collected statistics, which showed an increase in the volume of transactions by more than 10 times within 1 year (2019-2020).

Most apps run on the Ethereum network, performing certain decentralized finance functions. About 45% of new DeFi DApp solutions were made on the ETH blockchain, and 95% of all DApp financial transactions are carried out in Ethereum DeFi applications. Uniswap, SuperRare, DYDX and many other platforms are based on Ethereum.

Still, in 2022, other blockchains are also gaining popularity. For example, the EOS network began to upgrade actively in 2022, so the upward trend will definitely continue in 2023. Blockchain is helping new games to emerge, including Upland.

This application allows people to buy and sell digital property linked to a real address. From 50 to 80% of new users join the NFT game every month.

Read Next: What Are DApps and What Are They Used For in 2022?

Conclusion

The described trends will definitely continue for 2023, so everyone who wants to enter the crypto world needs to follow the trends to be aware of the latest changes and events. The modern financial market is difficult to predict, especially since new solutions, innovations, and technologies appear every year. One thing is clear: modern developments in the field of cryptocurrencies will continue entering business and everyday life.

Leave a Reply