Ethereum’s transition to Proof-of-Stake (The Merge), which has been expected for several years, took place last week on September 15th. Thus, miners, who consumed as much electricity as the whole of Finland, are no longer needed to maintain the blockchain.

Still, the question arises as to what miners should do now. How will people who maintained the network on the Proof-of-Work consensus earn money now? Let’s try to find out!

Recent Ethereum Upgrade Saves Gigawatts of Energy

The PoW algorithm, which powered Ethereum, required the constant solution of complex mathematical puzzles. To do this, miners created huge farms with powerful computer equipment that consumed gigawatts of electricity.

After migrating to PoS, it is enough to have money on an Ethereum wallet connected to the Internet to validate transactions. Mining farms do not need to be used, which makes it possible to save energy in the amount that an entire country consumes.

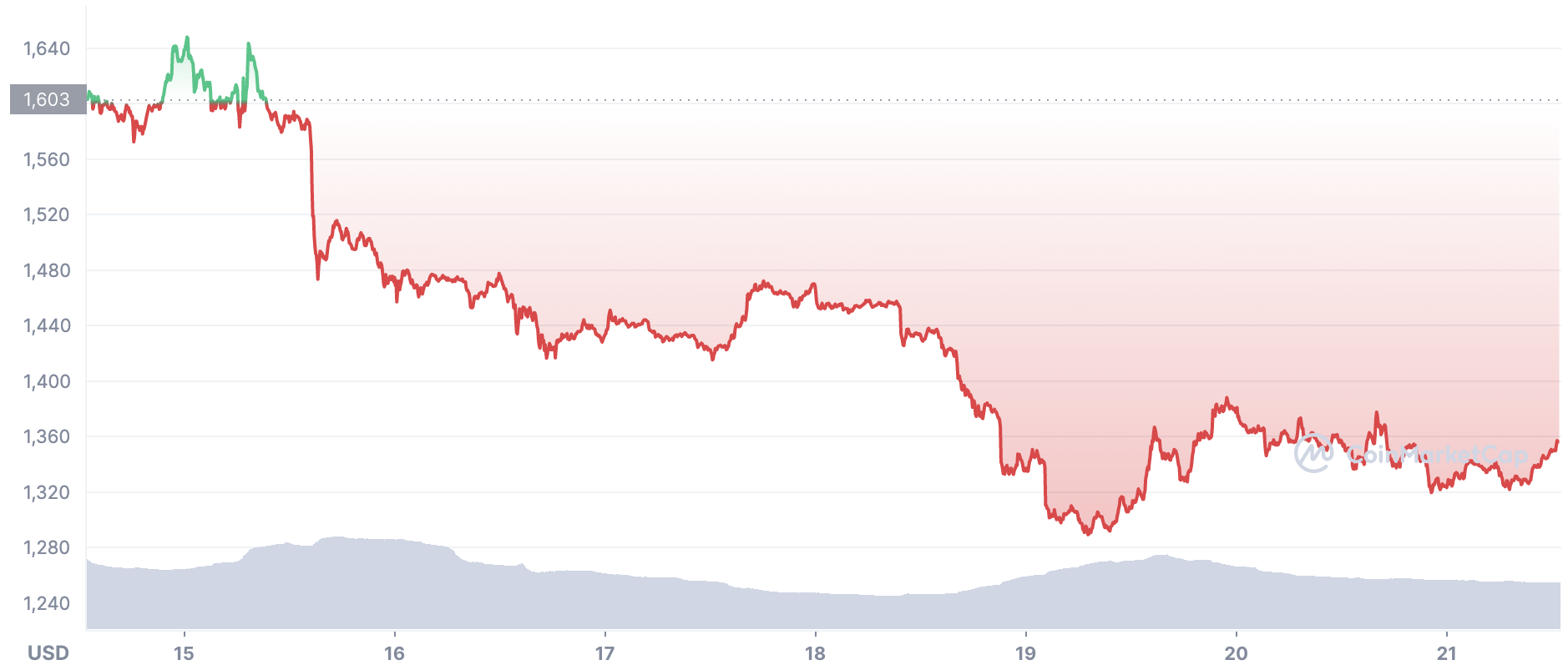

It should be noted that such a significant event for the blockchain had practically no effect on the cryptocurrency exchange rate. Thus, the price fluctuations did not go beyond 1%, and 1 ETH was worth $1,501 on September 15.

How Will The Merge Affect Miners?

Anyone who has at least 32 coins in their wallet can become a validator on the new Ethereum blockchain. The coins must be sent to a special address without the possibility of withdrawal. After that, the algorithm randomly selects a node that can attach the next block in the network. The more ETH is staked, the more likely it is to attach a record and get rewarded.

What to do with expensive mining farms that used to mine ETH? You don’t really need to get rid of them. Ethereum Classic and some other digital assets have blockchain construction algorithms similar to Ethereum 1.0. It will not take long to reconfigure the equipment for mining other coins, especially for those miners who prepared for the transition in advance.

But here another issue arises: whether alternative coins will be liquid. The lower the demand for them, the less stable their exchange rate. Thus, there is probability that mined coins could not be exchanged for fiat or more liquid coins.

Leave a Reply