The cryptocurrency industry is constantly evolving, and more and more people want to join it. However, it can be difficult to understand what’s going on at first glance. That’s why today we decided to create a guide to Bitcoin for beginners, where you’ll learn what this cryptocurrency is, how to use it, and how it works from a technical standpoint.

What Is Bitcoin (BTC)?

Bitcoin is a decentralized payment system and the very first cryptocurrency. It eliminates the need for banks and other intermediaries to conduct financial transactions. It was launched in 2009 based on a technical document created by someone named Satoshi Nakamoto (whose true identity is still unknown). In the documentation, Satoshi expressed the opinion that the world needs an electronic payment system where individuals can trust automated cryptographic proof instead of trusting their funds to third parties and corporations.

The technology of Bitcoin operates on a network formed by volunteers — private individuals who maintain it for financial reward. Program management is carried out through cryptography, the science of secure transmission of information that can only be read by the sender and recipient. Thus, unlike fiat currencies backed by gold or trust in authorities, Bitcoin is backed by open-source code.

How Does Bitcoin (BTC) Work?

- At the heart of Bitcoin operation lies the so-called blockchain, a public ledger that records data on all transactions in the network. All transactions conducted between users are ‘packed’ into blocks, which are then added to the chain — hence the name blockchain. It is technically impossible to change the information added to the blockchain. Thus, blockchain provides both transparency and reliability.

- The storage and management of Bitcoin is carried out using a private and public key. Their joint operation allows the wallet owner to create and sign transactions being sent.

- The network support and the generation of new currency are ensured by miners. Before being added to the blockchain, each transaction must be verified for its honesty and legitimacy. This is what miners do. For each generated block of transactions, they receive a certain financial reward (currently 6.25 BTC). Every 4 years, a Bitcoin halving takes place, and the reward is reduced by half. The approximate time between blocks is 10 minutes.

BTC is a trading symbol for bitcoin, used in wallets, exchanges, etc. As for the question of how to earn money with BTC: despite the initial idea of Bitcoin as a payment system, today, it is primarily relevant as a trading and investment asset with very high volatility. This volatility carries risks but also offers good opportunities for earning money through market speculation.

Bitcoin (BTC) Vs. Fiat Money

The concept of Bitcoin and cryptocurrencies in general aims to achieve advantages over traditional fiat currencies (such as the dollar, euro, yen, etc.). Here are a few key criteria that demonstrate why crypto is a more comfortable and reliable payment tool:

- High divisibility. 1 BTC coin is divided into 100,000,000 satoshis, which allows for even very small transfers to be made.

- Free storage and low cost. If you need to transfer money from one country to another, it is more convenient to do it in Bitcoin than through a bank. International bank transfers can take several days and involve high fees. On the other hand, Bitcoin allows you to transfer funds to any part of the world much faster and cheaper. Moreover, you have to pay bills, while Bitcoin wallets do not charge any storage fees.

- Lack of government regulation. Although some countries’ governments try to ban Bitcoin and do not recognize it as a payment method, they cannot technically prohibit private transactions with it. The network is not controlled by a single centralized authority that can be pressured, which is its strength. Therefore, those countries that apply reasonable regulations to cryptocurrencies act wiser.

- Impossibility of counterfeiting. It is impossible to make a fake Bitcoin, a currency that exists only in digital form and is based on a special software code. It is also impossible to bypass the blockchain, which records all transactions and all issued BTC.

Thus, Bitcoin has every chance to become an alternative to world currencies over time. And for now, it is of interest as an asset compared to gold in terms of investment characteristics.

How to Use Bitcoin (BTC)?

Let’s move from theory to practice. Using BTC has many nuances and complexities, but we will try to help you understand them.

Crypto Wallets

Bitcoin is stored in special cryptocurrency wallets. However, it can be said conditionally as only a set of information about incoming and outgoing transactions for a specific address is stored, not the currency itself. Based on this information, the balance is determined. The wallet’s task is to securely store private and public keys. A pair of keys is needed to automatically sign transactions when they are sent, confirming ownership, and decrypt incoming transfers.

Main types of Bitcoin wallets with examples:

- Desktop (on PC or laptop): Bitcoin Core, Electrum, Wasabi.

- Mobile (on smartphone or tablet): Green, Bitcoin Wallet, Samourai.

- Web (online sites with wallet functionality): Blockchain, Coinomi, BitGo.

- Hardware (physical USB device where keys are stored offline): Ledger, Trezor, KeepKey.

- Paper (printed keys for autonomous storage offline)

The most secure wallets are considered those that allow users to store keys on their side (on a PC, phone, paper, or hardware device). Services that store keys can be convenient and relatively secure, but one should be wary that they can be hacked and gain access to your funds.

Addresses

To send and receive cryptocurrency, you need addresses. A Bitcoin address is a unique set of letters and numbers that follows certain rules. During your crypto activity, you may come across three different types of addresses. They all have the same functionality but are supported by different wallets and services:

- Standard format P2PKH (Legacy): for example, 1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN4.

- Updated format P2SH (Segwit): for example, 3J98t1WpEZ78CNmQviecrnyiWrnqRhWNLy.

- The most advanced format is Bech32: for example, bc1qar0srrr7xfkvy5l683lydnw9re59gtzzwf5mdq.

You will not be able to send coins to an address format that is not supported by the selected wallet.

Sending & Receiving Bitcoin

To send Bitcoin, go to the appropriate section of your wallet, enter the recipient’s address and the desired amount. In addition, some wallets allow you to adjust a transaction fee. Below, we will describe what it is and why it is needed.

To find out your BTC receiving address, go to the ‘Receive’ or similar section of your wallet. There you will be able to copy the address of your wallet. For security reasons, the address will change in most wallets after each incoming transaction. However, all old addresses can still be used as they are formed based on your keys and are inextricably linked to them.

Bitcoin Network Fees

Adjusting commissions allows you to increase or decrease fees, thus adjusting the balance between transaction speed and costs.

Miners earn a portion of their income from fees on all transactions included in a block. That is precisely why they prefer to process the most expensive payments first. If you set a commission too low, likely, it will never be processed.

Some cryptocurrency wallets set the commission and do not allow it to be adjusted. In this case, they base their decisions on the current blockchain load and aim to optimize expenses.

How to Buy Bitcoin (BTC)?

If you’re wondering where to buy BTC, you should definitely think about buying it at Switchere. On our platform, you have an opportunity to buy BTC in the fastest and most convenient way. Moreover, we offer some surprising bonuses! Users of our platform enjoy a 0% service fee for the first order.

How to buy BTC with USD? At Switchere, you can buy crypto for fiat money or swap crypto for crypto. In addition to traditional purchases with a bank card, you can use alternative payment methods available (SEPA, SOFORT, Google Pay & Apple Pay, and local Asian banks)

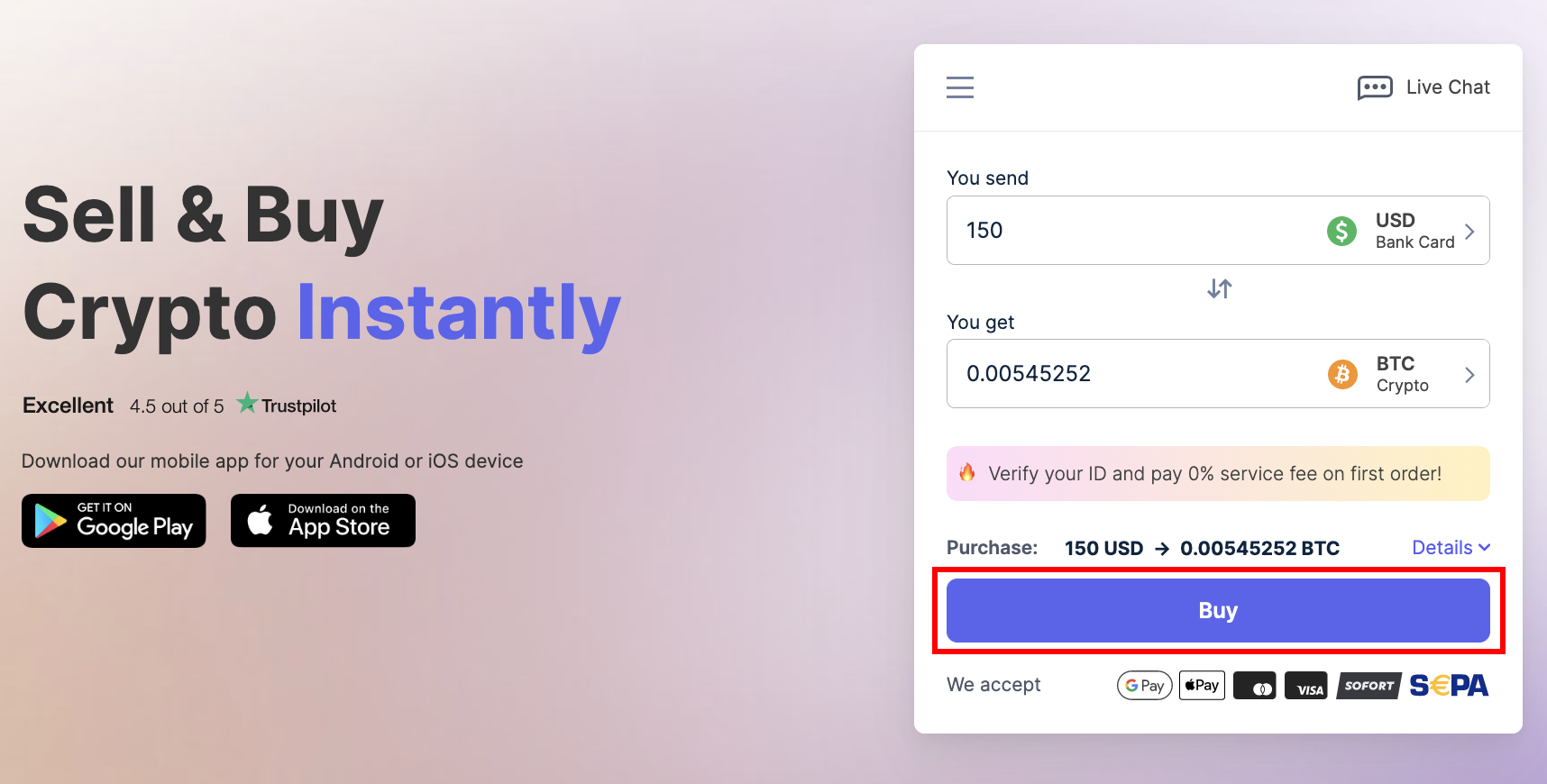

Here is an easy step-by-step guide on buying BTC at Switchere!

- Visit our website and log in to your account.

- Choose the currency pair for exchange as well as a payment method and enter the amount. Don’t forget to check the transaction details by clicking on ‘Details.’ Once you’ve done, click the ‘Buy’ button.

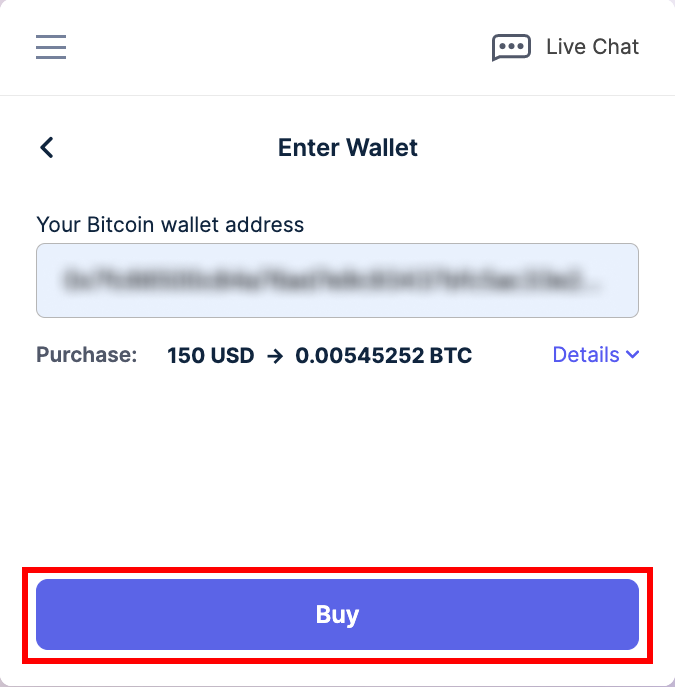

- Specify your Bitcoin wallet address and click on the ‘Buy’ button.

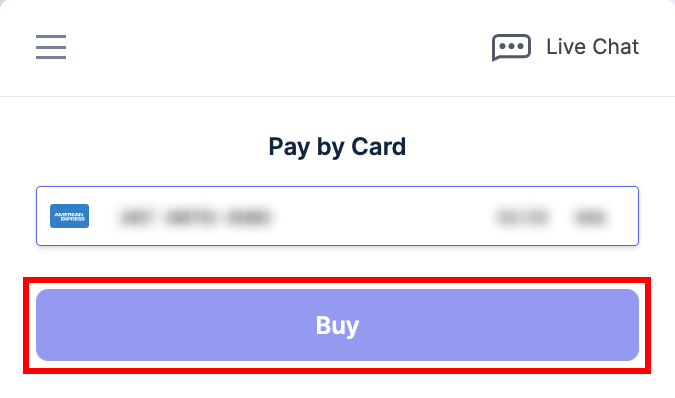

- Enter your card details and click on the ‘Pay Now’ button. Please take into account that you have a limited amount of time to send your funds. Elsewise, the transaction will be canceled automatically.

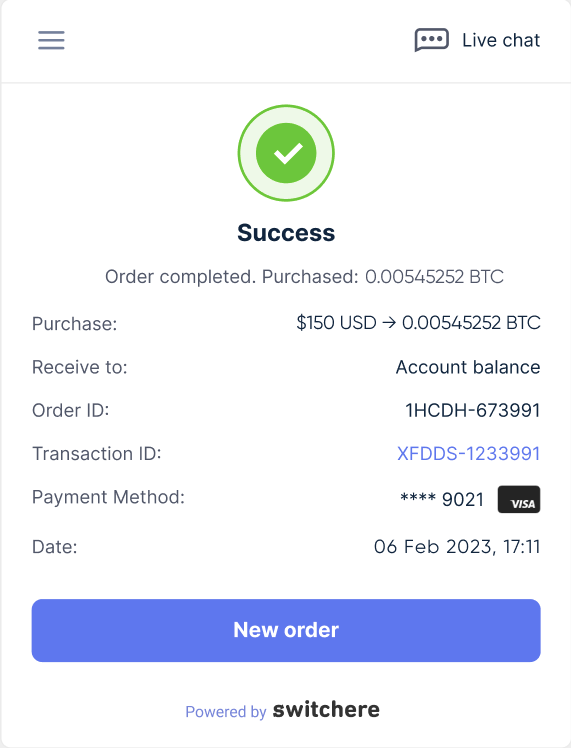

- Once you send the funds and your transaction receives the required number of blockchain confirmations, the amount of purchased BTC will be sent to your provided wallet address accordingly.

- Congratulations! The transaction is completed, and now you can check your Bitcoin wallet.

Usually, Switchere transactions take 5-30 minutes. If you have any issues with the exchange process, let us know at [email protected].

Prospects

Most experts agree on the future growth of the value of Bitcoin to $100,000, $200,000, and even $1,000,000. It is noted that over the past few years, the coin has had a truly stable growth that no longer resembles the hype of 2017. Many institutional investors, large companies, and payment systems have turned their attention to Bitcoin. All this speaks in favor of further growth and development of the cryptocurrency.

Bitcoin’s foundation has significantly strengthened, making it an effective defensive asset that protects savings from inflation, just like gold. Along with the popularity of the first cryptocurrency, other cryptocurrencies follow suit.

Conclusion

Bitcoin is a modern decentralized payment tool and, at the same time, a promising investment asset. Therefore, even if you are not planning to invest in it at the moment, it is necessary to learn about the principles and features of its operation. There is every reason to believe that in a few years, cryptocurrencies will become a full-fledged alternative to fiat currency, thanks to their unique properties in terms of anonymity, universality, accessibility, and, most importantly, decentralization.