Italy stands as an intriguing case with its evolving regulatory framework for digital assets and crypto payments. With an increasing global embrace of digital currencies, Italy has been making significant strides in providing a structured legal environment for businesses and individuals engaging with cryptocurrencies.

This article aims to delve into the regulatory norms and statutes, licensing requirements for businesses and virtual currency exchange operators, and the options available for legal crypto payments in Italy.

Italian Accepted Regulatory Framework for Digital Currencies

Italy has not yet implemented specific directives or bills solely dedicated to virtual currencies. However, it has addressed the usage and trading activities of digital assets within the existing jurisprudential framework. The Italian government, through various institutions and regulatory bodies, has been actively involved in formulating policies and guidelines related to digital assets.

Around five years ago, the Italian government publicized a decree implementing the EU’s 5AMLD, thereby requiring virtual currency-related businesses to follow the Financial Intelligence Unit requirements. This directive necessitates crypto exchange operators, custodian virtual currency wallet providers, and other platforms dealing with digital assets to undeniably act in full agreement with AML as well as CTF official standards.

Licensing and Registration Requirements

Business entities intending to function as virtual currency exchanges or custodians in Italy are mandated to complete registration with the Bank of Italy and the Italian Companies Register. They must follow strict AML/KYC obligations imposed by international regulators, generate and send corresponding reports, in tandem with implementing top-notch security measures to guarantee adherence with regulatory norms.

Acceptance of Virtual Currency Payments in Italy

Businesses in Italy can legally accept cryptocurrency payments. However, such transactions are subject to taxation requirements.

Crypto Payment Gateway Options in Italy

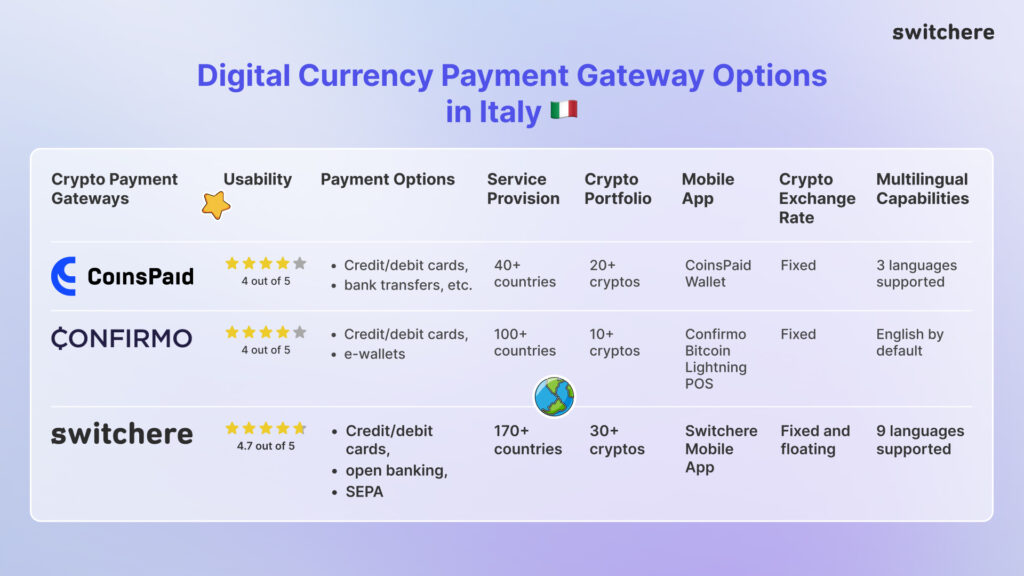

To facilitate legal virtual currency payments, various online payment gateway options are available in Italy. Companies like CoinsPaid, Confirmo, and Switchere offer services that allow businesses to accept cryptocurrencies seamlessly while ensuring compliance with regulatory requirements. These platforms offer solutions such as instant conversion to fiat currency, reducing exposure to the volatility of cryptocurrencies.

CoinsPaid

CoinsPaid has been in the crypto exchange business for around a decade and specializes in rendering turn-key crypto payment solutions for businesses and individuals alike. It renders a cornucopia of services, ranging from crypto merchant solutions, POS terminals, and business wallets to OTC Desk.

Around 8 percent of all Bitcoin on-chain payments are processed via CoinsPaid, whereas €700 m worth is processed in crypto monthly. Being an EU-licensed exchange, the firm adheres to mandatory AML standards and has a robust KYB system and risk monitoring filtering to prevent any unsanctioned use of digital assets.

Confirmo

Similar to CoinsPaid, the founding year of Confirmo dates back to 2014. The firm offers mass payouts, its branded POS terminal, transparent pricing, demo payments, and fast settlements. In general, the Confirmo crypto payment service provision is used by different e-commerce stores, SaaS digital businesses, forex brokers, etc.

Switchere

Switchere has been operating in the crypto exchange industry from 2019 onwards and renders both B2C and B2B services. At Switchere, you can purchase the most popular cryptocurrencies with fiat money, or exchange crypto-to-crypto in the fastest and most convenient ways, using any available payment method. Regarding B2B relationships, the firm offers easy-to-integrate crypto payment gateways with a free sandbox testing environment for its partners. Businesses interested in accepting crypto payments can receive instant payouts in fiat or crypto and boost their sales lightning fast.

Another useful feature offered by Switchere is smart plug-and-play NFT Checkout, which allows accepting crypto and fiat for NFT sales. Switchere takes care of all KYC onboarding and guarantees full legal compliance with the EU regulator.

Conclusion

Italy is gradually adapting its regulatory framework to accommodate the growing prominence of virtual currencies. While the Italian virtual currency regulatory framework is evolving, business entities and individuals can engage with digital assets within the defined legal boundaries, ensuring compliance with AML/KYC norms and state tax legislative basis. The availability of compliant payment gateway options further facilitates the adoption of virtual currencies in commercial transactions, providing a bridge between traditional finance and the burgeoning digitized sphere.

Leave a Reply