The crypto winter has caused once high-flying firms to file for bankruptcy and investors to sell off their crypto assets. Forbes has analyzed the implications of such trillion-dollar sell-offs. Today, we publish the seven most interesting conclusions.

Chaos in the Crypto Market

Economic collapses have claimed almost $2 trillion of the global crypto market value, frozen billions of dollars, and left thousands of people out of jobs. But this may only be the beginning. Everyone can only wonder if the current crypto winter will be as harsh and long as in 2014 and 2018.

In 2018, Bitcoin lost 80% of its value, and hundreds of new cryptocurrencies have sunk into oblivion. Marcus Sotiriou, an analyst at London digital asset brokerage GlobalBlock, suggests that the current recession could last up to 12 months unless inflation slows down.

Analysts have not agreed on when inflation will slow down. Cryptocurrency prices will need at least six months — and up to two years — to recover as they did before.

‘But this time, there’s a difference,’ he adds, pointing to a wave of institutional money from Tesla, Goldman Sachs, Morgan Stanley, and others. It was these giants that fueled widespread adoption during the pandemic.

Read Next: What Is a Bear Market in Crypto: Key Things You Need to Know 2022

The Crypto Market’s Biggest Losses in History

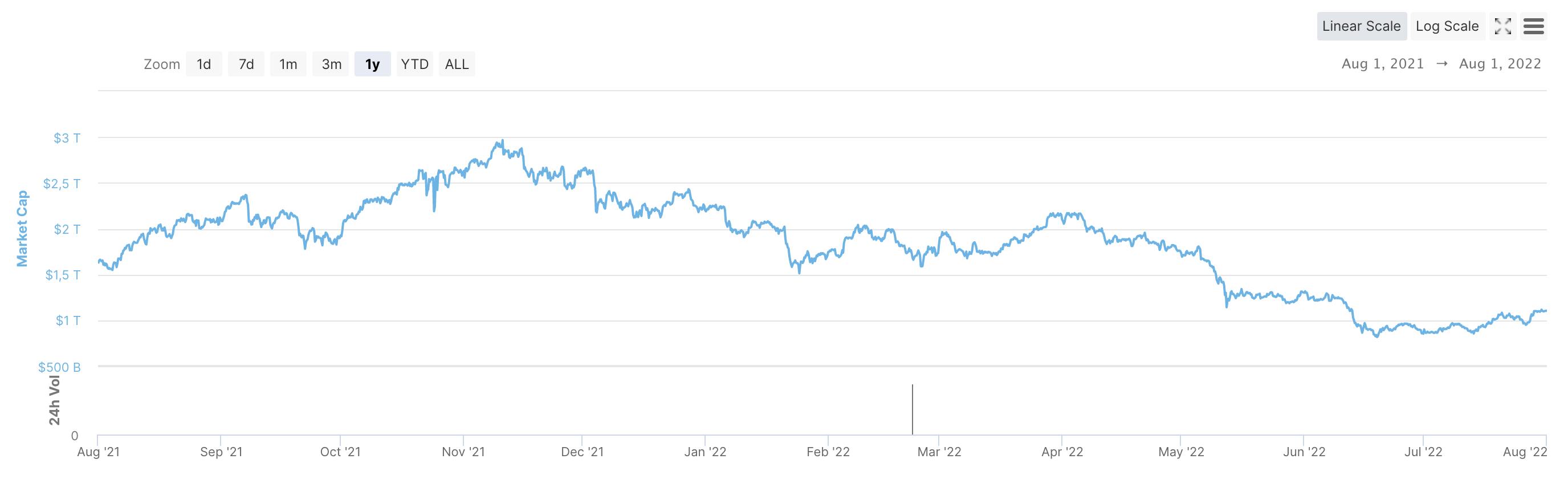

Low interest rates and incentive measures from the government have led to a rapid increase in the price of cryptocurrencies during the pandemic. But the decision of the Federal Reserve to stop the growth of inflation by raising the interest rate ‘froze’ investors’ interest in cryptocurrencies. In November 2021, the cryptocurrency market was valued at a record amount — more than $3 trillion.

Still, in July 2022, the crypto market lost 70% of its value, and this is the worst figure ever.

The market has climbed 33% since then, but according to CoinGecko, the current market valuation is still more than 60% below the highest one. Terra’s LUNA token, one of the most successful cryptos valued at more than $40 billion, almost completely depreciated in one week in May. This happened after TerraUSD, a stablecoin that was supposed to hold the price at $1, was no longer able to do so after the markets fell. Meanwhile, the top cryptos, Bitcoin, Ethereum, and BNB, fell 70%, 75%, and 65%, respectively, from their highest value. When such rapid declines happened in the past, it took years for the market to recover.

Read Next: Luna Crypto Crash: Key Reasons Why Terra’s LUNA Has Dropped 99.7%

Mass Layoffs

Cryptocurrency companies have laid off more than 3,000 people since June. Coinbase employees were the most unlucky: on June 14, the company fired 1,180 employees or 18% of the staff. It comes weeks after billionaire CEO Brian Armstrong warned investors that a potential recession could lead to a protracted cryptocurrency bear market. Armstrong said he was preparing ‘for the worst’ and acknowledged that the company ‘grew too fast’ during the pandemic bull market.

Also, in June, the Winklevoss twins’ crypto exchange, Gemini, announced that it would also lay off about 10% of its 1,000 employees. Crypto.com was about to say goodbye to 5% of the staff — about 260 people, and BlockFi — to 20%, or 170 employees. Since then, Celsius has reportedly cut 150 workers, and Austrian trading platform Bitpanda has lost 270 jobs, calling it a move that is ‘necessary to navigate the storm and get out of it financially healthy.’

On July 14, the OpenSea NFT marketplace also resorted to them, laying off 20% of its staff. This four-year-old startup was valued at $13.3 billion in January, thanks to a huge interest in NFTs that has since faded substantially. Blockchain.com announced a 25% employee reduction a few days after this announcement. Genesis, a crypto brokerage firm owned by Barry Silbert’s Digital Currency Group, announced on August 17 that it would cut 20% of its employees.

Record Selling

Investors rushed en masse to withdraw their money from crypto investment funds and did so so quickly that bitcoin fell to its lowest rate in 18 months. According to CoinShares, from June 13 to 17, a total of $423 million were withdrawn from such funds, which exceeded all investments this year, and the previous record outflow of $198 million, which was recorded in January. $ 21.6 billion is exactly the total value of crypto products in the management of funds in June.

A CryptoCompare analyst stated in a report that this value fell 37% from May to June, hitting an all-time low.

Even successful crypto firms must reckon with market volatility. Core Scientific, one of the top miners, sold most of its bitcoins in June for an average of $23,000 per unit, raising more than $167 million. In a statement, CEO Mike Levitt named ‘tremendous stress’ caused by a weak market, a higher interest rate, and ‘historic inflation’ as the reason for the sale.

Frozen Billions in Cash

Citing ‘extreme market conditions,’ crypto lender Celsius became the first major platform on June 13 to suspend withdrawals and transfers between customer accounts. A few days later, others took similar actions: Babel Finance, CoinFLEX, and Voyager froze withdrawals. Since then, only Voyager has resumed transactions, allowing transfers of up to $100,000 per day from August 11. The further, the more companies began to resort to cash frosts.

At the end of July, Singapore-based crypto exchange Zipmex temporarily suspended cashouts, citing market volatility and financial issues with an unnamed business partner; during the day, cashout was allowed again, but trading is still disabled.

Other firms are doing worse: on August 8, Singaporean crypto lender Hodlnaut was one of the last to freeze the ability to withdraw funds. The firm, which has about $500 million in assets under management, blamed ‘recent market conditions’ on the innovations, which include the cessation of token swaps and deposits. Hodlnaut states they are working on protecting the ‘long-term interests’ of their users.

Bankruptcies & Liquidations

A part of crypto firms just can’t handle the strain. On June 27, Voyager issued a notice of default to troubled Singaporean crypto hedge fund Three Arrows Capital (3AC), which failed to make payments on $675 million worth of bitcoin and stablecoin loans. Moreover, 3AC’s troubles were exacerbated with a sell-off in risky investments, reportedly including a large leveraged investment in the Grayscale Bitcoin Trust and about $200 million in a currently devalued LUNA. There were reports that on June 29, a British Virgin Islands court ordered 3AC to liquidate its assets, declaring the hedge fund insolvent. Thus, on July 5, the company filed for bankruptcy after suspending trading on its platform. In court filings, the firm disclosed more than 100,000 creditors and assets worth up to $10 billion.

Celsius was the next victim of the bear market, filing for bankruptcy on July 13. The company reported assets ranging from $1 billion to $10 billion, about the same amount of debt, and dozens of loans worth millions of dollars.

And this is not the end: Vauld announced that it was considering the possibility of debt restructuring after the ban on cash withdrawals.

Hodlnaut, a three-year-old company, applied for creditor protection with the Singapore High Court on August 13. The company wrote on its website that it wants to avoid a forced liquidation that would cause it to sell user assets at cut prices.

Prediction

Some crypto companies hope that more stable comrades by their side can save them. On July 1, Bankman-Fried’s FTX signed an agreement to buy BlockFi for $240 million. Meanwhile, it is reported that Goldman Sachs wants to raise $2 billion to buy out Celsius’ troubled assets, and other traditional institutions are interested in such a plan.

Leave a Reply