The financial landscape is undergoing a significant transformation with the advent of open banking, a system that provides third-party developers secure access to financial data through banking and non-banking financial institutions. This shift is setting the stage for a new era in digital transactions, offering an alternative to traditional card payments.

This article delves into the essence of open-banking payments, comparing them to card transactions, and highlights how they are carving a niche in the digital payment ecosystem.

Card Payments in Crypto Transactions: The Conventional Route

Card payments have long been a popular method for purchasing cryptocurrencies due to their convenience and widespread acceptance. Key features of using card payments in the crypto industry include:

- Immediate Access: Card payments allow for instant purchases of cryptocurrencies, facilitating quick market entry.

- User Familiarity: Many users are comfortable with card transactions, making it a go-to option for newcomers to the crypto space.

- Wide Acceptance: Most crypto exchanges and platforms support card payments, making it a versatile option.

However, card payments for crypto transactions come with drawbacks such as higher fees, potential for fraud, and sometimes limits on transaction amounts imposed by banks or card issuers.

Open Banking in Crypto Transactions: The Innovative Approach

Volt open banking is quickly gaining traction in the crypto industry as a secure and efficient alternative to card payments. Its integration into crypto transactions offers several compelling benefits:

- Enhanced Security: Open banking minimizes the risk of fraud by eliminating the need to share sensitive card information, using secure bank authentication instead.

- Reduced Fees: Transactions through open banking often incur lower fees compared to card payments, making it a cost-effective option for users.

- Faster Transactions: Open banking enables instant transfers, improving the transaction experience for both consumers and merchants.

- High Acceptance Rates: Direct bank transfers via Volt open banking have a near 100% acceptance rate, significantly reducing the chances of transaction failures.

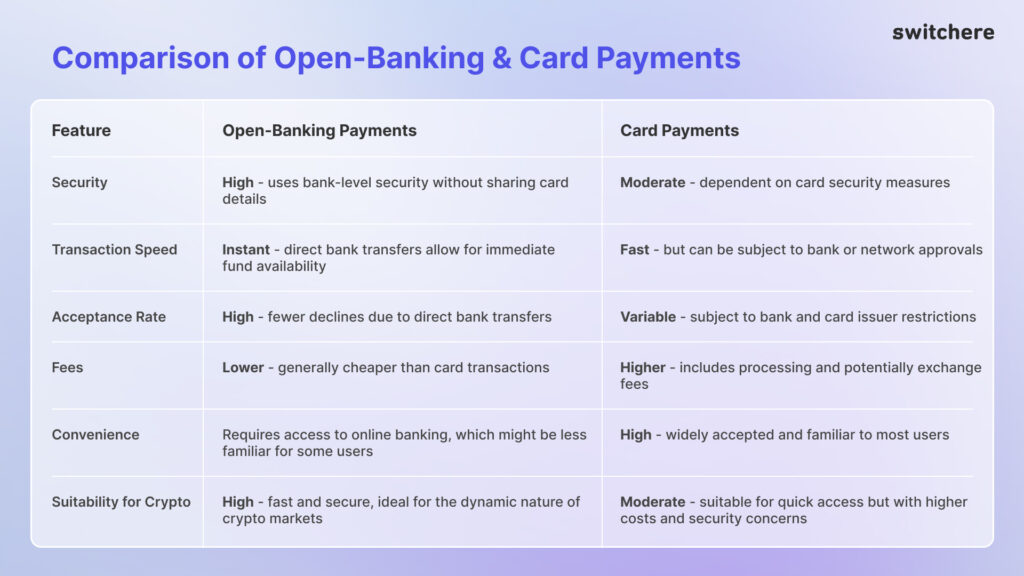

Comparison of Open-Banking & Card Payments

The table below offers a concise comparison of open-banking and card payments in the crypto industry, highlighting their key differences:

The Shift in Market Share

Open banking is gradually gaining market share from traditional card transactions due to its compelling advantages. The increased security, efficiency, and lower cost associated with open-banking payments are appealing to both consumers and merchants and align with the digital and fast-paced nature of the cryptocurrency market. As awareness grows and technology advances, more users are likely to transition to open-banking solutions for their payment needs.

Advantages of Volt Open Banking: Faster, Safer, and More Acceptable

Open-banking payments outshine traditional methods by offering a faster, safer, and more universally accepted means of transaction. The direct bank-to-bank transfer mechanism minimizes the points of failure, reducing the risk of fraud and unauthorized transactions. The instant processing of payments enhances the user experience, making it an attractive option for real-time transactions.

Volt Open-Banking Payment Method at Switchere

Switchere has embraced the open-banking revolution by integrating the Volt payment method. This integration allows Switchere users to buy all leading cryptocurrencies seamlessly using open-banking payments.

Here’s what users can expect with this innovative payment method:

- Security: Volt leverages open banking’s secure authentication for safe transactions.

- Speed: Cryptocurrency purchases are completed instantly, enhancing the user experience.

- Low Fees: Users benefit from lower transaction fees compared to traditional payment methods.

- High Acceptance: The direct transfer mechanism ensures a near 100% acceptance rate, making it a reliable option for users without unnecessary delays or denials.

In conclusion, the increased adoption of open banking in the crypto industry presents a promising shift towards more secure, efficient, and user-friendly transactions. As the digital asset space continues to evolve, the adoption of innovative payment methods like open banking will play a crucial role in shaping its future, making cryptocurrency transactions more accessible and appealing to a broader audience.