The times when there was only one blockchain are long gone. Today, dozens of independent chains operate in the crypto space, such as Ethereum, Solana, BNB Chain, as well as many side chains.

Gradually, the problem of incompatibility between blockchains arose. For example, you cannot directly use Bitcoin in protocols running on Ethereum. Various options are being developed to solve this problem (cross-chain bridges, multi-chain networks like Cosmos, Polkadot, etc. In our today’s article, we will suggest considering another interesting option — wrapped tokens, widely used in decentralized finance.

What Is a Wrapped Token?

A wrapped coin is a tokenized version of another cryptographic asset. The name is explained by the fact that the original asset is placed in a kind of wrapper or shell — and in fact, in a digital storage that allows you to create its tokenized version in another blockchain network.

The wrapped token can be used on a network that is not native to the original asset and, when it is no longer needed, exchanged back for the original cryptocurrency.

You may notice that wrapped coins are similar to stablecoins because they also receive value from another asset. But stablecoins, as the name implies, strive for price stability, so they use a fiat asset as collateral. Wrapped tokens have different purposes, and volatile cryptocurrencies are used as the source.

How Do Wrapped Tokens Work?

Let’s consider the general principle of a wrapped token. Depending on the project, there may be minor differences, but this is how wrapped tokens work in most cases.

Each existing wrapped token has a similar number of original coins, which are kept by a custodian. The principle of operation includes two steps:

-

- A seller initiates a minting process, i.e. sends the original asset to a custodian.

-

- The custodian mints a wrapped token and sends the seller an amount equivalent to the reserves placed in the source.

-

- Similarly, the seller can send a wrapped token to the custodian and receive an original asset.

It should be noted that the security and reliability of wrapped tokens largely depend on the custodian’s reliability. After all, they store the funds sent by sellers for minting.

Wrapped Minima Token (WMINIMA)

Recently, we have announced our partnership with Minima Global and have listed their wrapped token WMINIMA. Minima is a layer-1 blockchain and peer-to-peer network that fits on a mobile or IoT device, allowing every user to run a full constructing and validating node.

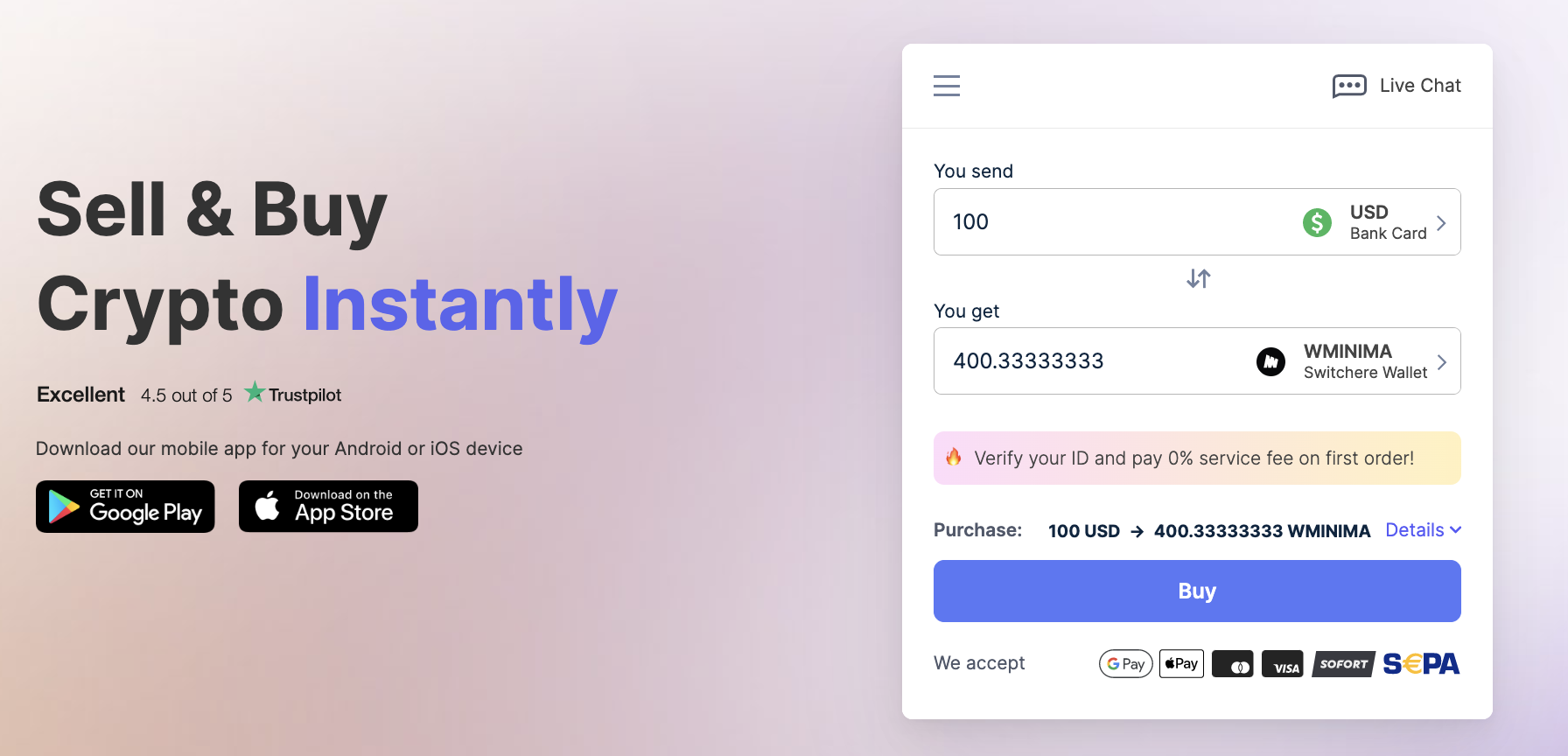

Thus, if you’re wondering where to buy Wrapped Minima, you should definitely think about doing it at Switchere. On our platform, you have an opportunity to buy WMINIMA in the fastest and most convenient ways using any available payment method.

Switchere is characterized by the fastest order processing and instant delivery — in fact, you get your ordered amount of crypto within minutes after making a payment. Moreover, we offer some surprising bonuses! Users of our platform enjoy a 0% service fee for the first order.

What Do Experts Think About Wrapped Tokens?

So, wrapped tokens guarantee convenient interoperability between blockchains so that users can easily move assets and take advantage of functionality and apps on other chains, and not just on the one in which their asset operates. This can provide a host of benefits, including faster transactions, reduced fees, or increased profits from yield farming.

Thus, the volumes of wrapped tokens in circulation continue to grow. Cross-chain bridges are considered the main competitor to this solution. However, this method is riskier since protocols are an attractive target for hacker attacks. In January 2022, Vitalik Buterin noted that he is ‘pessimistic about cross-chain applications’ precisely because of their security vulnerabilities. He shared his thoughts on this issue on his Twitter and Reddit accounts.

One way or another, achieving interoperability between different blockchains is a difficult but necessary task for the entire sector. For the foreseeable future, bridges and wrapped tokens will continue to be the top choice.

Key Advantages & Disadvantages of Wrapped Tokens

Pros

-

- The ability to use a tokenized version of any cryptocurrency on a non-native blockchain.

-

- Reducing the time of transactions and transaction fees (subject to the use of a more efficient blockchain).

-

- Improving the efficiency and liquidity of the use of capital.

-

- Simple and fast creation of wrapped coins, accessible even to a beginner. You can also simply buy/sell such assets on CEX or DEX.

Cons

-

- A minting process can be costly as it is also associated with transaction fees.

-

- Initial funds are held by a custodian. It is necessary that they provide the ability to track your reserves.

Conclusion

Much of the decentralized finance ecosystem runs on the Ethereum blockchain. Therefore, wrapped tokens and other solutions for compatibility between different chains are of great benefit for owners of BTC or other cryptocurrencies — you can trade or earn them on yield farming in a decentralized way, without intermediaries, and this does not require you to sell your assets. A reverse exchange is possible at any time. For the protocols themselves, this is also beneficial, as it adds additional liquidity from other chains. Not surprisingly, the solution is being actively developed, and new tools for its implementation are emerging.

Leave a Reply